One factor blockchain groups succeeded in way back: coopting the cash printer, from the preliminary coin choices, or ICOs, within the late 2010s, to the current-vintage “token era occasions,” or TGEs. Within the previous days, shares have been bought by funding banks to purchasers fortunate sufficient to get an allocation. These days, sizzling tasks simply airdrop the newly manufactured tokens to customers as rewards, they usually begin to commerce. This week noticed airdrops from the cross-chain bridge staff Wormhole and the “artificial greenback” mission Ethena, whose tokens out of the blue have a mixed circulating market capitalization of greater than $3 billion.

This text is featured within the newest concern of The Protocol, our weekly e-newsletter exploring the tech behind crypto, one block at a time. Enroll right here to get it in your inbox each Wednesday. Additionally please take a look at our weekly The Protocol podcast.

We’re additionally protecting:

-

Ethereum’s new “blob market” enters “worth discovery mode.”

-

Vitalik Buterin riffs on meme cash.

-

High picks from the previous week’s Protocol Village column on blockchain tech information: Celestia, Arbitrum, Degen, Picasso, Cosmos, Avail, dWallet, Somnia.

-

>$75M of crypto mission fundraisings.

-

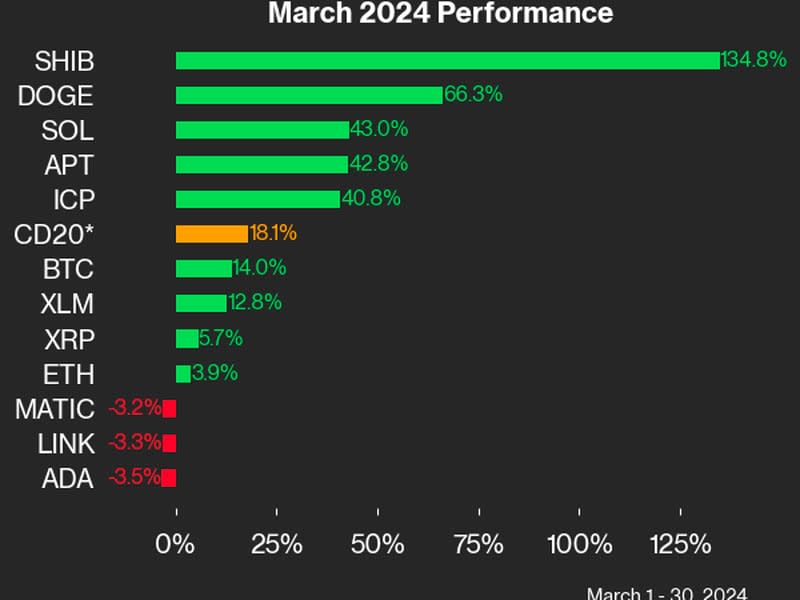

Leaders and laggards within the benchmark CoinDesk 20 index for March.

SYNTHESIZING DOLLARS: Again in February, The Protocol wrote in regards to the perceived dangers across the crypto mission Ethena, with its new USDe token – termed a “artificial greenback” with eye-catching yields (at present 35%) from funding perpetual futures positions on derivatives exchanges. There are many believers within the mission, apparently, or no less than loads of speculators. On Tuesday, Ethena airdropped some 750 million ENA tokens, or roughly 5% of the general provide – for a first-day circulating market capitalization of about $1.2 billion. (The absolutely diluted valuation, primarily based on the general provide, works out to about $12 billion.) The success of the airdrop may mirror the present urge for food for risk-taking amongst crypto merchants, and the unbowed willingness of crypto structured-finance alchemists to check the waters for merchandise with ever-increasing complexity. Earlier this week, a separate mission, the derivatives protocol Cega, unveiled “Gold Rush, a basket choices technique involving the Ethereum blockchain’s ether (ETH) token and Tether’s gold-backed XAUT tokens as underlying property, alongside a security element that protects customers’ capital from a 30% drop within the property’ costs,” as reported by CoinDesk’s Omkar Godbole. “The product presents an annualized share yield of as much as 83% to buyers who stake ETH, Lido’s staked ether (stETH), wrapped bitcoin (wBTC), or stablecoin USDC within the choice technique vault, Cega mentioned. The yield is paid out within the type of the cash staked, so ETH stakers obtain ETH in yield, offering an uneven upside in a bullish market.” The hope, after all, is to keep away from any uneven draw back.

BLOBS, BLOBS, BLOBS. The Ethereum blockchain only a couple weeks in the past accomplished its landmark Dencun improve, together with the extremely anticipated EIP-4844 proposal that created a devoted area for storing information – referred to as “blobs,” underneath a plan to scale back charges whereas additionally relieving congestion. Nevertheless it did not take lengthy for a brand new mission to return alongside and jam up the so-called blob area, sending charges hovering and offering the nascent blob market with its first massive stress take a look at. As reported final week by our Margaux Nijkerk, Ethereum gasoline charges for blobs spiked “after a mission known as Ethscriptions created a brand new means of inscribing information, or minting inscriptions, on the info blobs, known as ‘blobscriptions.'” In a weblog put up on Thursday, Ethereum co-founder Vitalik Buterin acknowledged that the Blobscriptions episode had pushed the brand new blob-fee market into “worth discovery mode,” however he added that the info charges nonetheless remained far cheaper than they might have been underneath the previous system of parking information as “calldata” in a daily Ethereum transaction.

Talking of Buterin, he additionally riffed on meme cash. “One reply to this conundrum is to shake our heads and virtue-signal about how a lot we’re completely abhorred by and stand towards this stupidity. And to some extent, that is the proper factor to do,” he wrote. “However on the similar time, we are able to additionally ask one other query: If folks worth having enjoyable, and financialized video games appear to no less than generally present that, then might there be a extra positive-sum model of this entire idea?” Spoiler alert: His reply was not sure/no. (Fwiw go right here for our personal riff final week on the meme coin frenzy on Coinbase’s Ethereum layer-2 chain, Base.)

ALSO:

-

Wormhole, the blockchain bridge mission, airdropped its W token on the Solana blockchain, with plans ultimately to broaden to Ethereum and layer-2 networks by way of its “Wormhole Native Token Transfers,” or NTTs. As reported by our Oliver Knight: “Holders will be capable of delegate W tokens to participate in governance votes. Delegation can happen on Solana or any of the appropriate Ethereum-based chains in a course of that’s being dubbed the ‘first ever‘ mutlichain governance system.”

-

Roughly $503 million was misplaced throughout 233 on-chain safety incidents within the first quarter, a 54% enhance versus the primary quarter of 2023, in line with a brand new report by the blockchain safety agency CertiK. Non-public key compromises have been the costliest assault vector.

High picks of the previous week from our Protocol Village column, highlighting key blockchain tech upgrades and information.

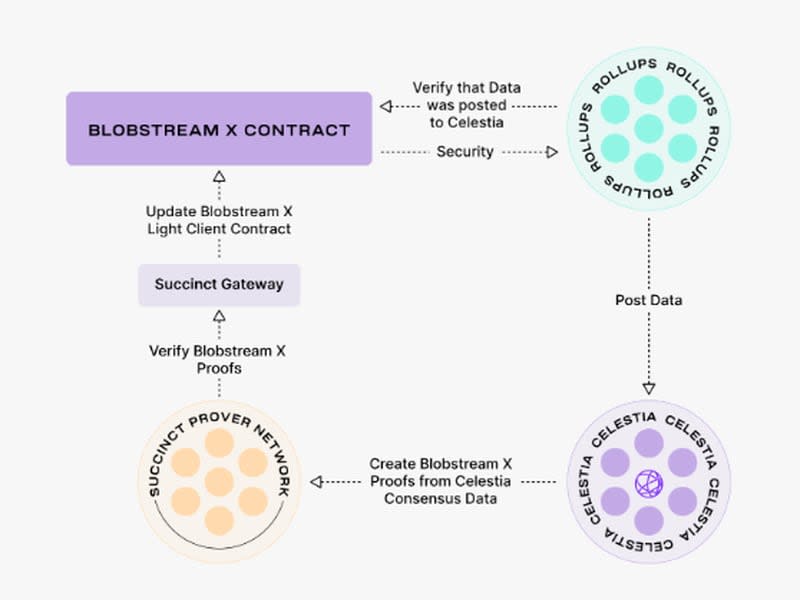

Schematic displaying how Celestia’s Blobstream works. (Celestia)

1. Celestia, a blockchain data-availability mission, mentioned its Blobstream product – for relaying commitments of Celestia’s information root utilizing an on-chain mild shopper, has deployed to Arbitrum One. In line with the staff: “Builders can quickly deploy Orbits with Celestia beneath on Arbitrum One and Base, the primary modular DA integration with working Nitro fraud proofs.”

2. Degen, a neighborhood token within the Farcaster ecosystem, and Syndicate, a Web3 infrastructure supplier, launched Degen Chain, an ultra-low-cost L3 for the $DEGEN neighborhood constructed with Arbitrum Orbit, Base for settlement, and AnyTrust for information availability. In line with the staff: “The chain’s native gasoline token is $DEGEN, making it one of many first neighborhood tokens with its personal L3.”

3. Picasso Community, a Cosmos-rooted interoperability community, introduced an integration between the IBC (Inter-Blockchain Communication Protocol) and Ethereum, “enabling seamless asset and information transfers between Ethereum and Cosmos” for the primary time, in line with the staff: “Picasso chosen Osmosis, the DeFi Hub, to function the first vacation spot for Ethereum property and liquidity inside the Cosmos. This integration is a step ahead in bringing ‘IBC all over the place,’ and serves to attach a few of the deepest liquidity reserves and most promising tasks within the Ethereum and Cosmos ecosystems.” The staff plans a Solana-IBC connection later this month.

4. Avail, a modular blockchain resolution designed to unify Web3 and optimize information availability (DA), has partnered with dWallet Network, “a pioneering non-collusive, decentralized multi-chain layer, to deliver programmable native Bitcoin to rollups within the Avail ecosystem,” in line with the staff: “Leveraging the newly unveiled dWallet primitive, good contracts utilizing rollups constructed on Avail DA will be capable of programmatically handle native BTC for the primary time whereas preserving consumer possession.”

5. PROTOCOL VILLAGE EXCLUSIVE: The Digital Society Basis (VSF) is introducing the Somnia Undertaking, consisting of an L1 and omnichain protocols tailor-made for the metaverse, “aiming to unite disparate digital realms right into a cohesive society able to onboarding tens of millions of customers,” in line with the staff. “Developed in collaboration with Inconceivable, Somnia’s blockchain boasts transaction speeds >100K TPS, with sub-second finality, and affordability, addressing the fragmentation plaguing the metaverse panorama and guaranteeing equitable worth distribution amongst creators. Particulars of the mission have been launched Wednesday together with a litepaper. The VSF, unveiled final week, was initiated by Inconceivable, a British metaverse-focused startup that raised $150 million in 2022 from buyers together with a16z and SoftBank.

Fundraisings

IoTeX Group (IoTeX)

-

IoTeX, an Ethereum-compatible blockchain optimized for DePIN, introduced a $50 million funding from Borderless Capital, Amber Group, Foresight Ventures, FutureMoney Group, SNZ, Metrics Ventures, EV3 and Waterdrip Capital into the IoTeX Ecosystem, “to fulfill the rising demand for bridging real-world information with IoT gadgets to Web3,” in line with the staff.

-

XION, a brand new “generalized abstraction” layer-1 blockchain launched final month by Burnt Banksy, introduced a $25 million fundraise “to in the end summary away all crypto complexities, making Web3 accessible to everybody,” in line with the staff. Traders included Animoca Manufacturers, Laser Digital (Nomura), Multicoin, Arrington Capital, Draper Dragon, Sfermion and GoldenTree, in line with a press launch. (EDITOR’S NOTE: Protocol Village coated the XION launch in early March when Burnt Banksy set himself on hearth as a part of an art-performance-cum-publicity-stunt.)

-

PROTOCOL VILLAGE EXCLUSIVE: Official, an on-chain mission to maintain bodily property in sync with their digital counterparts, has closed its $4.3 million seed spherical, led by Lemniscap, with participation from Draper Associates, Sfermion Issue VC and others. In line with the staff: “Official allows tasks to embed a variety of digital content material into their bodily items by way of Official’s LGT Tags, that are particular encrypted NFC (Close to Discipline Communication) chips which can be built-in seamlessly into purchasers’ provide chains and manufacturing processes.

Offers and grants

-

Origin Protocol introduced that its OGN token holders have proposed to merge OGN and OGV tokens, to spice up Ethereum liquid staking, in line with the staff: “OGN – Origin’s first token, launched again in 2020 – was listed on Coinbase simply months later. OGV, which has been appreciating tremendously, displays Origin’s rising income and complete worth locked. The objective of the merger is to capitalize on OGV’s undervaluation, because it serves as the worth accrual token for Origin’s DeFi merchandise, together with the profitable Origin Ether, which has over $160 million in complete worth locked. OGN is backed by Reddit co-founder Alexis Ohanian, YouTube co-founder Steve Chen and Y Combinator president Garry Tan.”

-

Helika, a worldwide infrastructure supplier for conventional and Web3 gaming companies like Yuga Labs and Animoca Manufacturers, introduced it’ll launch a $50 million accelerator program funded by Pantera, Spartan Capital, Sfermion and different enterprise capital companies.

-

Stellar Improvement Basis is launching the Soroban Safety Audit Financial institution, which is able to distribute as much as $1M in safety audit credit in coordination with six top-tier audit companies to 20-30 excessive precedence tasks (monetary protocols that handle on-chain worth and which have the potential to be extensively used) constructing on Soroban, their subsequent era good contracts platform which simply accomplished mainnet launch.

Information and Tokens

We have been writing about varied meme coin buying and selling frenzies for all of March – first on Solana, after which on Base. Or possibly it was actually only one massive meme coin buying and selling frenzy? Regardless of the case, it will be fairly arduous for us to feign shock at this level that the doggy-themed SHIB and DOGE ended up because the month’s two top-performing tokens of the month within the benchmark CoinDesk 20 index. Ethereum’s ETH was a bit extra muted, gaining simply 3.9% because the blockchain’s massive Dencun improve went as easily as probably might have been anticipated. Solana’s SOL was an enormous winner, gaining 43%:

Bitcoin, the oldest and largest cryptocurrency, rose 14%, extending its successful streak to seven straight months and handily beating the Customary & Poor’s 500 Index of U.S. shares in addition to the gold worth:

April 8-12: Paris Blockchain Week.

April 18-19: Token2049, Dubai.

April 19 (estimate): Subsequent Bitcoin halving.

Might 9-10: Bitcoin Asia, Hong Kong.

Might 29-31: Consensus, Austin Texas.

June 11-13: Apex, the XRP Ledger Developer Summit, Amsterdam.

July 8-11: EthCC, Brussels.

July 25-27: Bitcoin 2024, Nashville.

Aug. 19-21: Web3 Summit, Berlin.

Sept. 19-21: Solana Breakpoint, Singapore.

Sept. 1-7: Korea Blockchain Week, Seoul.

Sept. 30-Oct. 2: Messari Mainnet, New York.

Oct. 9/11: Permissionless, Salt Lake Metropolis.

Oct. 21-22: Cosmoverse, Dubai.

Oct. 23-24: Cardano Summit, Dubai.

Oct. 30-31: Chainlink SmartCon, Hong Kong

Nov 12-14: Devcon 7, Bangkok.

Nov. 20-21: North American Blockchain Summit, Dallas.

Feb. 19-20, 2025: ConsensusHK, Hong Kong

Dec. 5-6: Emergence, Prague